|

medical insurance for dogs cost, decoded with real numbers and quiet pitfallsI like clear math, not mascots. Policies promise a lot; I want to know what they actually cost and how they behave when a vet bill lands in your lap. What really drives the price you pay- Breed risk: French Bulldog, Labrador, German Shepherd often price higher than mixed breeds due to claims data.

- Age: premiums step up each birthday; starting young matters because pre-existing issues lock out coverage later.

- ZIP code: urban care costs push rates up; rural can be cheaper, sometimes not by much.

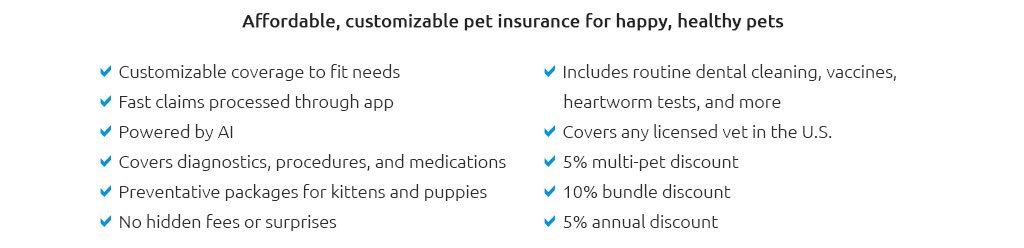

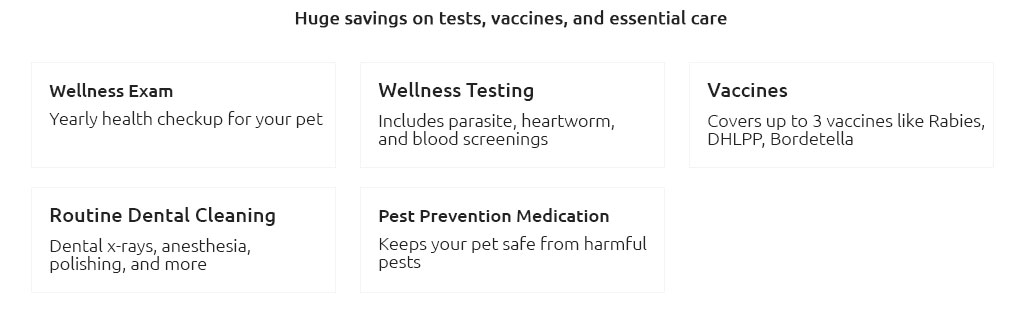

- Coverage type: accident-only is cheaper; accident+illness is the norm; wellness add-ons increase cost and rarely pay for themselves.

- Deductible, reimbursement, annual limit: higher deductible and lower reimbursement drop the premium; unlimited annual limits raise it.

- Inflation: vet costs trend upward; expect annual premium increases even without claims.

- Claim history: frequent high claims can nudge future premiums, even if not immediately.

Typical price ranges (not quotes)For a healthy 1-year-old medium mixed breed with 80% reimbursement, $500 deductible, $10k annual limit: roughly $35 - $70/month. Large or brachycephalic breeds: $60 - $120+. Seniors: $90 - $150+ and rising. Accident-only: roughly $10 - $25/month. Yes, wide ranges - because underwriting cares about details you can't control. Quick math you can do on any quote- Find the deductible, reimbursement%, and annual limit.

- Estimate a mid-size emergency: $3,200.

- Out-of-pocket ≈ deductible + coinsurance on the rest: $500 + 20% of $2,700 = $1,040.

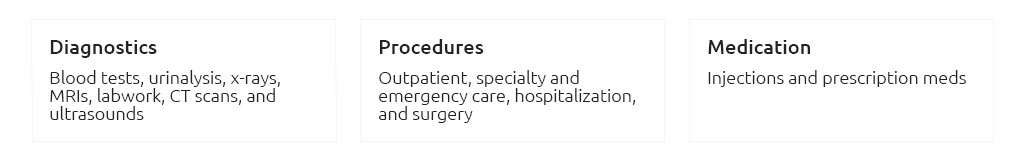

- Check if exam fees, prescription meds, or diagnostics are excluded; add those back if not covered.

A real-world midnight momentMy neighbor's retriever swallowed a sock at 2 a.m. Surgery total: $3,200. With 80% reimbursement, $500 deductible, no exam-fee coverage, they paid about $1,100 all-in after a week's reimbursement. Saves the day, but notice how the deductible and exclusions shape the bill. Hidden levers that change cost (and value)- Waiting periods: cruciate/hip can have longer waits; accidents may be shorter. A claim inside the window is often denied.

- Pre-existing clauses: any prior signs/symptoms - even if undiagnosed - can be excluded. Skeptical aside: coverage sounds generous until you read how "prior symptom" is interpreted.

- Bilateral limitations: tear one knee, the other knee may be excluded as "pre-existing counterpart."

- Dental: injury is commonly covered; periodontal disease is usually not.

- Therapies: rehab, acupuncture, or behavioral meds might require specific riders.

- Per-incident vs annual caps: annual unlimited can be worth it if you fear cancer or multiple issues in one year.

- Fee structure: some charge per-claim fees; small but annoying.

What "cost" feels like over timeMonthly premium is only part of it. There's also volatility. Insurance trades a steady payment for protection against rare, expensive events. If the plan is hard to use, that steady payment feels worse. That's why trust and usability matter as much as price. Self-insure vs insure: a sober checkSay you pay $60/month ($720/year). Over 10 years, ignoring increases, that's $7,200. One cruciate repair can be $4,000 - $8,000; cancer care can reach $10,000 - $20,000. If you can't comfortably cash-flow a bad year, insurance stabilizes risk. If you can, a high deductible plan plus savings may be the efficient middle. How to compare with confidence- List your dog's details (age, breed, prior issues). Be honest; omissions can void claims.

- Pick two or three benefit sets to price: e.g., 70%/$500/$5k, 80%/$500/$10k, 90%/$1,000/unlimited.

- Run three scenarios: stomach surgery $3 - 5k, cruciate $4 - 8k, cancer $6 - 20k. Compute your out-of-pocket for each plan.

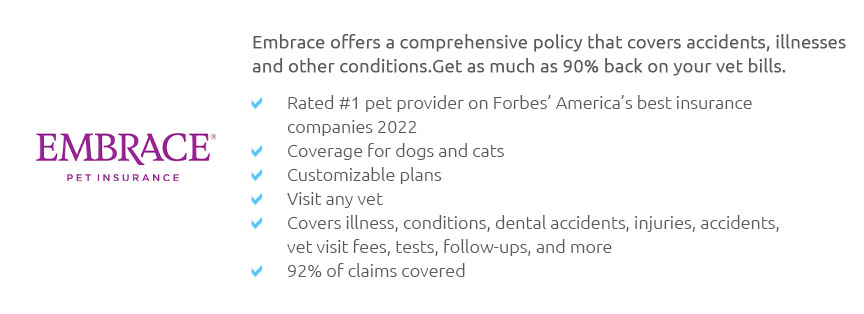

- Probe usability: claim submission in-app, typical payout time, direct pay vs reimbursement, pre-authorization for big procedures. This is where trust lives.

- Read the sample policy: definitions of pre-existing, bilateral, exam fees, prescriptions, alternative care, and dental.

- Ask about rate changes over the last 3 years for your ZIP and breed. Prices drift; surprises erode trust.

Final thought from a skeptical readerI still read exclusions twice and assume the premium will rise annually. If the math and the experience still look good, that's a policy I can live with. If not, I'd adjust deductible and reimbursement until the numbers - and the usability - feel sane.

|

|